Table of Content

- Today’s gold rate: Gold slips by Rs 1,400 after surge of Rs199! Details here

- Interest rates increased for the 8th time in 8 months

- Home loans EMI: How to control rising EMI, know details here

- Can I get an approval for a home loan while I decide which property, I should purchase?

- According to HDFC, only customers with credit scores of 800 or higher will be eligible for the new rate of 8.65 per cent.

- What are the reviews of Prestige High Fields, Hyderabad?

- Home Finance Popular Links

At this rate, SBI gives home loans to customers with a credit score of more than 750. It’s advisable to limit your loan payment to a maximum of 40% of your monthly income. Making regular prepayments before the home loan tenure is over can help to reduce your interest payments considerably. Borrowers should keep paying off money lump-sum so that the principal decreases substantially over years.

The bank’s normal rate is 8.90 percent for those with a credit score above 800. Similarly, the festive offer rate of ICICI Bank starts from 8.75 percent. This is also available to customers with 750 plus credit score. EMI refers to the ‘Equated Monthly Installment’ which is the amount you will pay to us on a specific date each month till the loan is repaid in full.

Today’s gold rate: Gold slips by Rs 1,400 after surge of Rs199! Details here

Pre-EMI is the monthly payment of interest on your home loan. This amount is paid during the period till the full disbursement of the loan. Your actual loan tenure — and EMI payments — begins once the Pre-EMI phase is over i.e. post the loan has been fully disbursed.

The repo rate has been raised by 140 basis points between May and August. When lending rates rise, banks typically lengthen loan terms. If there is no financial hardship, you might prefer to lengthen the loan’s term rather than increase the EMI amount. You can control the interest expense by limiting the tenure, which will result in significant savings. After increasing the repo rate of RBI, one after the other, from banks to housing finance companies are increasing the interest rates. After SBI, now HDFC has also increased the home loan interest rates.

Interest rates increased for the 8th time in 8 months

Earlier, HDFC increased its benchmark lending rate by 5 basis points for existing borrowers with effect from May 1. Banks or lending institutions give a lot of importance to the credit score while giving a credit card or loan to a person. If a person has a good credit score, then he can take a loan at low interest rates.

Read today’s latest news, live news updates, most reliable Hindi news website News18 Hindi. Make sure you have an emergency fund so that your EMI payments are not impacted in case you face such a situation. Taking a home loan during your Twenties or Thirties gives you sufficient time to pay off your loan before retirement. Is there any limit to which I can increase the monthly EMI. From what I know, there’s no process to increase EMI in HDFC online. You can refer to the above answer from Parvinder to know about the overall procedure.

Home loans EMI: How to control rising EMI, know details here

HDFC said in its statement, “HDFC has decided to increase its Retail Prime Lending Rate on housing loans. Adjustable Rate Home Loan has been increased by 35 basis points. Borrowers having limited liquidity can opt for the home saver option. Under this facility, an overdraft account is opened in the form of a current or savings account where the borrower can park his surpluses and withdraw from it as per his financial requirements. The interest component of the home loan is calculated after deducting the surpluses parked in the savings/current account from the outstanding home loan amount.

Now that you are convinced about the benefits of taking a home loan, what about home loan repayment, you may ask. There are a number of home loan repayment options that you could consider. However, before we discuss this, let’s understand how home loans are repaid. Your home loan is repaid through equated monthly instalments, or EMIs. This is a fixed amount you need to pay your lender each month till you complete repaying your home loan.

Negotiate with your Bank

According to HDFC, only customers with credit scores of 800 or higher will be eligible for the new rate of 8.65 per cent. Since there is no penalty on pre-payment of home loan, therefore bank should not object to increasing your EMI. The additional amount that you pay over and above your actual EMI shall be considered as Principal repayment and that much amount can directly be adjusted from the outstanding principal. You can go to HDFC Limited or HDFC Local bank with the most recent loan statement. It must show the amount of interest and principal that has been paid so far and the remaining balance that needs to be paid.

You can apply for a pre approved home loan which is an in-principal approval for a loan given on the basis of your income, creditworthiness and financial position. Generally, pre-approved loans are taken prior to property selection and are valid for a period of 6 months from the date of sanction of the loan . A HDFC home loan provides numerous benefits such as facility to apply online, quick loan processing, attractive interest rates, customized repayment options and simple &hassle-free documentation.

This is why you should always keep affordability as a primary factor when selecting your loan EMI amount. I took a loan of $ __________ for _____________ (Purpose – Car Loan/ Education Loan – Mention Loan Purpose) and which was to be repaid in ____________ (Number of EMI’s). I want to increase the installment amount to _________ due to __________ (Increase in Salary/ Financial Reason/ Personal reason) so as to reduce installments.

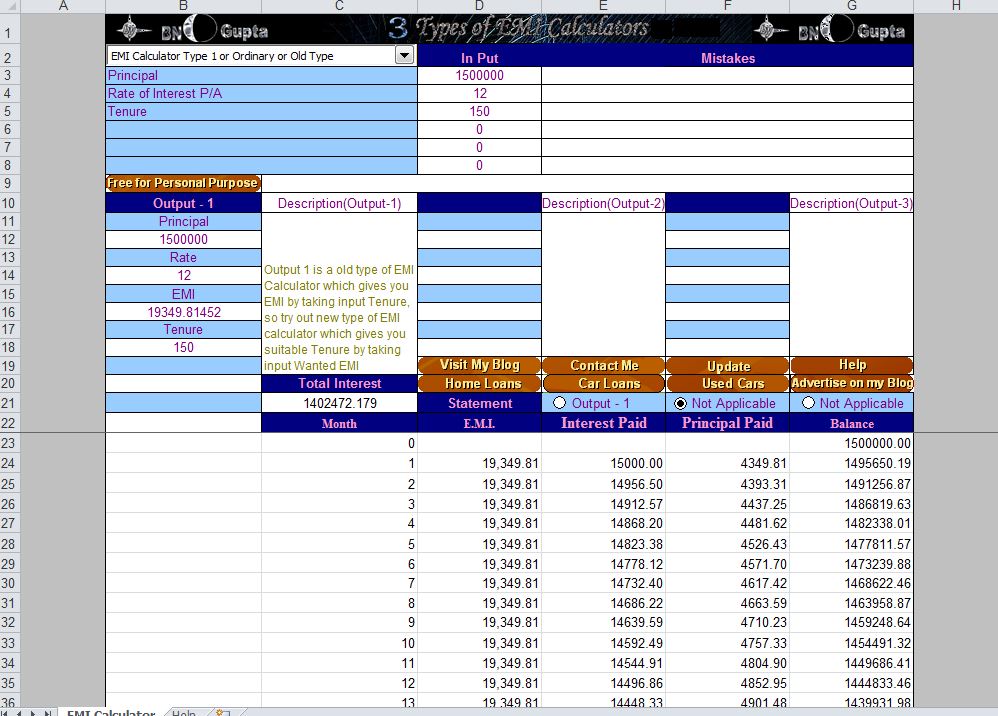

Keep these transaction costs in mind before refinancing your home loan. “Home loans and other retail loans linked to repo rates would witness the quickest transmission of policy rate hikes. The transmission would be quicker for fresh floating rate retail loans," said Naveen Kukreja - CEO and co-founder, Paisabazaar. HDFC’s EMI calculators give a fair understanding about the ratio of the principal amount to the interest due, based on the loan tenure and interest rates. EMI calculator also provides an amortization table elucidating the repayment schedule.

Since bank is going to loose out on overall interest, they may suggest you to invest the additional amount in some other instruments and continue with regular EMI . I suggest if you are not looking at Tax benefits and planning to close your loan early, then make lumpsum payments every quarter or so. I want to increase the EMI to 1 lakh per month for an year. Please suggest if it is a wise option or shall i wait for an year or few months to deposit lump sum amount. However, I recommend you opt for the EMI amount that you can afford. Though a shorter loan tenure will lead to a lower absolute interest payout, it’ll also increase your EMI burden.

No comments:

Post a Comment